The Banks in the Economy

The recent legislative initiative, called “Resolution Agency Law”, gave rise to intense discussions, which have not lacked in demagoguery and populist, anti-capitalist and anti-Western overtones. Beyond the latent dangers posed by the underlying substance of these tendencies, the major problem is that the project “may generate a systemic risk in the banking sector, inducing risks and endangering the financial sector stability with implications for the entire economy” (EC, Romania Country Report 2016, Brussels, 26.2.2016, p. 2-3).

A significant contribution to the popularity enjoyed by the promoters of the law, in addition to the support of powerful interest groups, is the general public’s precarious knowledge regarding the connection between banks and economy, despite the fact that the population has more frequent interactions with the banking sector than prior to 1989, when the only banking institution authorized to transact with individuals was the “Savings Bank” (CEC). Currently, banks are a visible presence in the urban landscape, many customers being thoroughly acclimatized with the use of modern banking techniques (ATMs, cards, Internet banking, etc.). However, what a bank actually is and how it functions are subjects less familiar to the majority portion of the Romanian society. Therefore, a sine ira et studio presentation of the banking institution may be useful to anyone interested in these current issues.

A “whig theory” of financial history

Current financial institutions are the result of a long historical evolution that began in antiquity, when operations like those termed today as “banking” (deposits, lending, currency exchange, etc.) were already carried out by professionals (called “keystone” by the Greeks and “argentaria” by the Romans). Modern financial systems consist of a multitude of organisations, the oldest ones being the banks created in the XIIth to XIVth centuries, and the newest ones being the financial companies (the investment funds) that have appeared in the 1970s and the 1980s. These complex and segmented financial systems include more or less specialized groups and networks, currently being the subject of numerous reforms which often change the typology, organization and functioning of these institutions.

Under these circumstances, the taxonomy of modern financial institutions is very fluid and prone to interpretation. Often, the literature refers to the following grouping: 1) banks and assimilated organisms, having as main objective money creation, and therefore are subject to the supervision of the central bank; 2) non-banking financial institutions, which do not create money and therefore should not be within the purview of the central bank.

The modus operandi

Banks create money by granting loans to their clients. Economists term this credit based money to distinguish it from commodity based money specific for previous monetary systems (gold standard, silver standard, bimetallism, etc.). Through lending, banks supply the necessary stock of money for the economy to function, at minimal transaction costs and other forms of friction, thus contributing to the optimization of resource allocation. Indeed, an economically rational entity that wants to participate in the exchange of goods would invariably use money because it reduces trade costs, saves time, makes the economy more productive (time saved can be used for productive activities) and enables faster gratification of needs with a better match-up of buyers and seller to maximize utility. In other words, the banks contribute, along with other categories of economic and market forces, to the optimal allocation of resources in society.

Currently, the main money types are: 1) script money, created by the so-called “commercial” banks; and 2) real money (cash banknotes and coins), created by the central bank. This monetary stance, which distinguishes banks from other financial institutions, does not mean that banks are not also financial intermediaries and operators of the capital market (stock exchange). The monetary function of banks is therefore nested in their financial function.

Transactions made by commercial banks can be divided into three main categories: a) transactions carried out with other banks (commercial banks and the central bank), which take place on the so-called “money market”; b) lending operations to non-banking sectors (businesses, population and government); c) providing financial services (payments, wealth management, consulting, etc.).

By far, the most important operation related to the non-banking sectors is obviously lending, because by nongovernmental lending (loans granted to businesses and households) the funding of many facets of the economy (consumption, investment, and high cost acquisitions) takes place. In actuality, the role of bank lending differs from country to country: banks and assimilated credit institutions are the main funders of the economy in Europe and Japan, while in the US this role is comparatively less pronounced and it is complemented by NFIs (insurance companies, pension funds, and other categories of financial intermediates). In Romania, the volume of loans granted to non-bank customers at the end of January 2016 was 216,112.2 million lei, equivalent to approx. 40% of GDP (according to NBR data).

Banks finance their loans through four types of resources: a) long-term available resources they obtain through long-term loans borrowed from other banks and financial institutions; b) equity (own capital and reserve funds); c) deposits available for a limited time span that banks receive from various customers similar to non-banking financial institutions; d) money created by the banks that, as we shall later describe, is both fuelled by deposits and then fuels deposits.

The destination of monetary resources is represented by loans and other financial placements granted by banks: a) loans to the public treasury through the purchase of state bonds; b) short-term, medium and long term loans to businesses and households; c) investments made in financial markets by buying long-term securities: shares, bonds, other financial assets; d) specific lending operations: leasing, mortgages etc. In Romania, at the current date, almost half of bank loans were denominated in foreign currency.

Under the hood

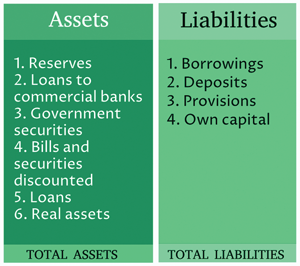

Given the previously stated facts, the balance sheet of commercial banks shows (in principle) as follows:

As shown in this simplified balance sheet diagram, the essential correlation is “total assets = total liabilities + net worth”.

The “Deposits” position requires a special attention. The word “deposit” is used here in a broad sense, covering a wide range of banking liabilities, from demand deposits and savings to bank liabilities documented by certificates of deposit, bonds issued by the bank, etc. The distinctive feature of all these bank liabilities other than net worth is that though to the bank they count as “debts”, to the non-banking sector (Main Street in American parlance, as opposed to Wall Street) they are more or less liquid “receivables”, and therefore perform the functions of money: a medium of exchange, unit of account, store of value, etc. Therefore, these receivables are considered and function as money, including all monetary aggregates (M1, M2, etc.). On the other hand, these deposits represent financial investments for their holders, because even if the initial deposit was created as a demand deposit, the final holder of a savings account usually requests an interest, its level depending on its liquidity and yield.

In this context, there may be some confusion, and to remove it requires some clarification.

Deposits can be made not only by regular inflows (wages and salaries, business and commercial incomes, etc.), but also when the bank grants a loan.

As long as it is funded by a previously opened deposit, the loan stands for a “non-monetary funding”: consequently, “banks lend other people’s money” – as it is often said. In this case banks play a financial intermediation role between individuals who save (i.e. spend less than they earn) and those who need those resources (i.e. spend more than they earn). In other words, the bank, as the NFIs also do, is connecting those who have disposable capital, but do not use it and those who would use it, but do not have it. The socially important process that arises from the redistribution of this scarce resource (i.e. the capital) and which could not exist in the absence of financial intermediaries is designated as “indirect funding” of economic activity.

But, when loans are covered by the deposit created once the loan is transferred in the client’s account, the bank credit is a “monetary financing”. The bank records the new loan as an asset in its balance sheet because the operation gives rise to a receivable on its client / debtor; equally, it recorded the same value as a liability (deposit) on behalf of the same client. These simple accounting records, however, have major economic consequences because bank deposits are (account) money, acknowledged as such, in all modern economies. But it is obvious that these operations do not involve a “financial intermediation” and, consequently, the financing of the economy is a “direct financing”.

Secondly, the deposit does not “disappear” as liability from the balance sheet when the borrowed amount is used by the client to purchase a good, a service or a financial asset. If the seller of the good, service or financial asset is another bank’s client, the deposit leaves the original debtor’s account and fuels the seller’s bank balance sheet, but does not leave the banking system until the original loan is reimbursed. Banks are, therefore, elements of an interconnected financial system, not isolated entities.

Finally, there is no reason to assume that this loan will be repaid immediately. On the contrary, a loan is granted precisely because it will serve to finance certain “real” economic activities (production, trade, consumption, investment, etc.) that generate, in turn, an increased demand for money. If loans are widely used to finance relatively unproductive economic activities, there is a generalized increase in the prices of goods, rendered services and financial assets (i.e. inflation occurs).

A summary of these aspects can be gleaned in the figure below:

Wall Street and Main Street

Since it is likely to cause inflation, funding through money creation has been widely discussed in the specialty literature throughout the post-war period. The recent crisis has shown, however, that this type of funding is equally important in terms of financial stability. As a result, economists have reconsidered the issue concerning how money can be inserted in order to fund the economy. One of the most important conclusions of these investigations is that real economic activities are supported by financing operations whose equilibrium is mandatory to achieve general economic equilibrium. Specifically, between the real economy, monetary stability and financial stability equilibria there are feedback connections: the equilibrium of the real economy influences the monetary and the financial stability, while the monetary stability and the financial stability influence, in turn, the equilibrium of the real economy. These complex and multidimensional connections are ensured by financial intermediation, which, thus, fulfils a major role in the normal functioning of the economy.

Regarding banks, they are dual financial institutions: “financial intermediaries” and “money creation centres”. However, looking at a bank, in isolation, the two forms of funding (i.e. non-monetary and monetary) cannot be separated. This is because assets and liabilities are depersonalized in the bank’s balance sheet, making it impossible to know whether a certain loan was granted based on a previous deposit (non-monetary funding) or following the lending procedure (monetary funding).

But things are different in the entire banking system, where, interestingly, the separation is possible.

Thus, to the extent to which, based on systematic and exhaustive information provided by the consolidated balance sheet of the banking system, the correlation between the dynamics of the stock of money and the evolution of production is demonstrated, all the flows generated by the lending and money supply are financial intermediation flows.

But, as far as the money supply grows faster than the production, the lending and the money supply processes generate flows that have no financial intermediation character and, therefore, are monetary financial flows.

Consequently, as financial intermediaries, banks cannot increase indefinitely the volume of loans. Due to this non-monetary stance, the lending potential of the banks is objectively influenced by the volume of deposits, which, in turn, depends on the rate of savings (total saving / GDP) and the ability of banks to attract deposits through an adequate business policy. In other words, the governing principle of the financial intermediation provided by banks is that “deposits make loans”. The consequence is that, in setting the interest, banks behave to a certain extent as any financial intermediary: they reduce or increase the interest rates of loans offered to their clients according to the general business cycle and their business policies.

As money creation centres, banks can increase or decrease instantly and significantly the volume of loans according to the estimates of the anticipated effects of these operations on their financial return. Again, such flexibility is possible because deposits represent purchasing power, which, by a set of accounting recordings, may vanish as quickly as it was created. This purchasing power is purely nominal and is not, instantly, consistent with a concomitant increase in the supply of goods and services or with “real” savings (which increase when the production increases or the consumption decreases and drops when the production decreases or the consumption increases). Thus, banks can open unlimited credit lines, may grant “loans based just on ID” (a phenomenon of consumption in Romania, just like the US market saw “liar loans” and “ninja loans”), may try to recruit new clients through aggressive advertising, etc., or, conversely, may demand immediate repayment of loans, may refuse to renew some of the previously granted credits, can sell bad debts to liquidators, etc. In this way, they may cause a sudden and noticeable expansion or contraction of credit and money supply. In other words, the principle applicable in terms of money creation is “loans make deposits”.

Financial critique and restraint

Funding the economy through money creation is severely criticized by old and new representatives of the Austrian school. According to these influential economists, in a two tier banking system, where at the top is the central bank, and at its core are a number of commercial banks, which retain only fractional reserves (relative to deposits), there is inevitably an artificial increase in credit and money supply. The artificial character of this expansion is due to the fact that the liquidity and credit evolutions are not met by an increase in domestic voluntary saving. As a result, investments financed through this channel are in fact “malinvestment” that distort phases of the economic process and, in the end, trigger, sooner or later, an economic crisis. The recent global financial crisis is an obvious endorsement for this original theory of the business cycle.

Since the expansion or contraction of credit in relation with the evolution of production and productivity increases or decreases the mark-to-market pricing of collaterals, this dynamics changes credit risk. Under these circumstances, adjusting lending interest margins does not immediately reflect a simple change in the credit demand / supply ratio. Actually, the banks’ reaction takes place both in the form of quantitative adjustment of the volume of loans they offer to their clients and in the form of interest margins modulation, i.e. the change in the price of capital they require from their business partners. In addition, the volume of loans and interest rates (demanded and offered) depends on cross border capital flows, on refunding facilities provided by the central bank, the interest rate fixed unilaterally by the latter and by many other factors (inflation rate, maturity, quality of borrowers, the taxation of income and interest expenses, etc.).

All these phenomena and determining factors are reflected in micro prudential indicators specific to the activity and the financial situation of a bank: turnover, market share, solvency, liquidity, profitability, etc. These indicators can be determined also at macroeconomic level; globally, they reflect the ability of the banking sector to resist various types of shocks and crises. Finally, macro prudential indicators can be linked to other macroeconomic variables (economic growth rate, inflation volatility, interest rate and exchange rate, unemployment rate, balance of payments position, etc.), which allows an overview of the effects of credit expansion and contraction on the economy and od the abundance or shortage of liquidity it generates.

The banks, therefore, face a number of technical limitations, not just of a financial nature, regarding their ability to rapidly increase the volume of loans. The most important constraint, manifested especially in the upward phase of the financial cycle in which all financial intermediaries – banking and non-banking – are trying to grant as many loans as possible and make as much profit as possible from the investment of funds, is the bank’s own assessment of future profitability and solvency. Typically, in the boom phase of the business cycle, the assessment is optimistic, which makes the banking business have a pro-cyclical activity. In this phase of the boom, the amount of available excess money related to the quantity of goods produced but not consumed is not an obstacle for lending and it can be compensated through money creation. The volume of lending resources obtained by encouraging savings influences, however, micro and macro prudential indicators, which is why the supervisory authority (central bank) sets certain standards for the respective indicators. Such benchmarks are determined also by international agreements (Basel III) or resilience simulations (Stress Tests), conducted under the guidance of the International Monetary Fund and the World Bank.

An important factor on which potential lending and money creation on the part commercial banks are dependent is the monetary policy (of an expansionist/restrictive orientation or neutral) of the central bank, which induces for banks a series of more or less severe financial constraints: required reserves, refinancing interest rates and payment of the deposit through commercial banks᾽ accounts opened with the central bank, arrangements for operations with government securities (open market) etc. In principle, this policy is necessary to offset the natural cyclical trend of the banking sector. In other words, a responsible central banker is “conservative”.

Conclusion

To summarise, modern banks have a complex activity: they are financial intermediaries and money creation centres for the non-banking sectors of the economy. From a practical standpoint, understanding this complexity has important consequences. We illustrate these consequences by giving a single example, though many others may follow.

Some economic policies stimulate investment by encouraging saving. However, banks finance investment not only from savings deposited by the population, but also with the money they create themselves. As a result, the funding by the bank of investment projects do not necessarily require prior savings, although it requires an additional monetary purchasing power, allowing investors to buy new equipment and facilities. After those purchases are made, business partners (upstream or downstream operators in the commercial chain) deposit the collected money in banks, which count as savings, but these savings are a consequence, not a cause of credit and investment. The macroeconomic role of savings converted into capital and materialized in the real economy as machinery, equipment, facilities, etc. should not be confused with the role of money created by the accounting based recording of bank liabilities and assets. The difference is reflected by the statement that “banks are not capital factories, albeit they are money factories”.

Given the mentioned factors, economic policy must pay attention to the capacity of the banking sector to identify and finance economic projects and stimulate savings likely to finance some of the desirable investments, thus alleviating the danger of excessive credit growth and that of the stock of money. The funding, through money creation, of productive economic activities complements the savings achieved in the past and makes possible future savings, but in the medium and long term it is “neutral” in the sense that it does not influence economic growth and the employability of the labour force. In the short term, it impacts on the volume of production and other real economic variables through prices or in other, less straightforward, ways. Moreover, excessive credit growth can cause inflation, financial instability and economic crisis.